- Wedbush's Dan Ives says Biden's infrastructure plan will be a "green tidal wave" for the EV sector.

- Ives sees roughly 10% or $200 billion of the plan going to EV initiatives.

- The analyst expects an expansion of tax credits "to the $10k range or potentially higher."

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

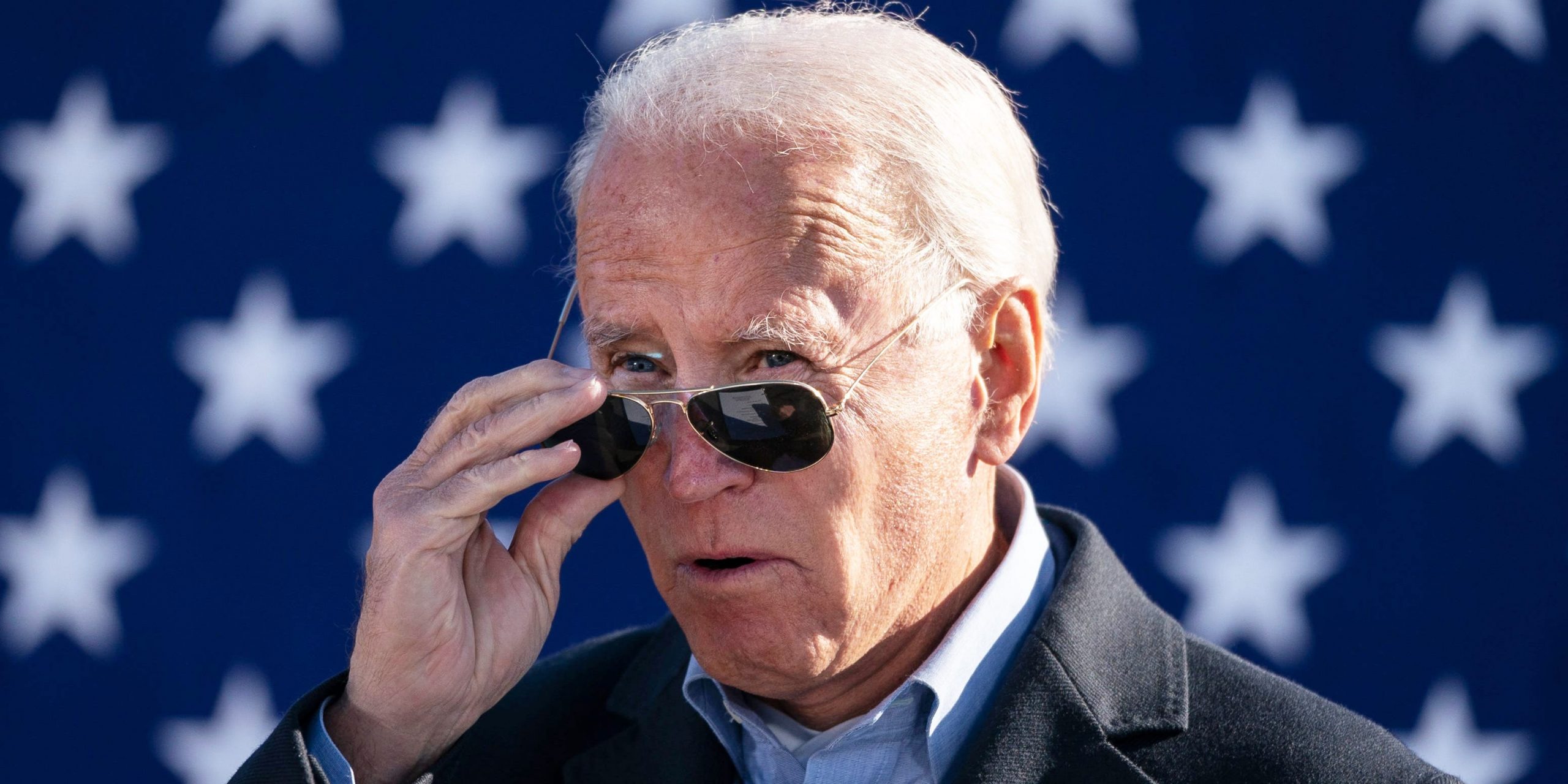

President Biden's infrastructure plan is set to be released on Wednesday afternoon and some analysts argue it will help revive the EV sector after its recent pullback.

Wedbush's Dan Ives said in a note to clients on Wednesday morning that he expects a "green tidal wave" from the plan to boost EV stocks.

The analyst said around $200 billion or roughly 10% of President Biden's plan could go towards electric vehicle initiatives "based on chatter out of the Beltway."

That's good news for EV stocks that have been battered recently by a rotation away from highly valued growth and tech names into more value-oriented plays.

Tesla stock is down some 28% from its January 26 highs, while EV names like Nikola and Lordstown Motors are down roughly 22% and 42%, respectively, over the past month alone.

In his Wednesday note, analyst Dan Ives said that "the Street" needs to see two specific components of the infrastructure bill pass through the House and get enacted in order to "change the game" for the EV sector in the US after the pullback.

First, Ives said he hopes to see an expansion of tax credits for EVs "to the $10k range or potentially higher in a tiered system."

Second, the analyst said he expects to see Biden lift the 200,000 vehicles per manufacturer ceiling on EV credits which would restore the incredibly valuable tax credits for veteran manufacturers like Tesla and GM.

Ives also said that an expansion of charging stations around the US over the next decade would help support a "groundswell EV green tidal wave for consumers/trucking."

The Wedbush analyst highlighted EV battery companies, recyclers, supercharging infrastructure firms, and commercial EV plays that are set to benefit from the infrastructure plan and EV boom as well.

Ives noted a considerable runway of growth for EVs in the US. EV sales represent just 2% of auto sales in the US compared to 4.5% in China and 3% globally.

According to Ives, the EV market represents a $5 trillion total addressable market over the next decade, which means "many EV OEMs/supply chain players are poised to be major winners over the coming years."

One thing that wasn't mentioned in the Wedbush note was that the infrastructure bill is set to be funded by tax hikes for corporations, which may hurt earnings.

Some reports say Biden's upcoming tax plan could contain up to $3.5 trillion in tax hikes for wealthy individuals and corporations.